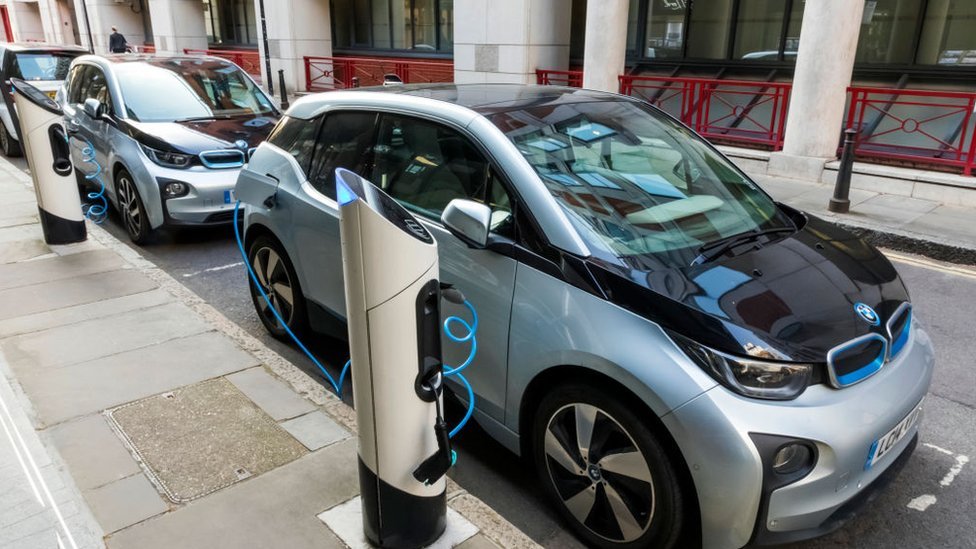

The UK’s automotive landscape is undergoing significant changes, driven by the government’s push toward a greener future. Recently, HM Revenue & Customs (HMRC) announced updates to tax policies that could have far-reaching implications for drivers of petrol, diesel, and electric vehicles (EVs). In this blog post, we’ll break down the key changes, explore their potential impact on vehicle costs, and discuss what this means for consumers and the broader automotive market.

Understanding the HMRC Update

HMRC’s latest tax adjustments are part of the UK government’s broader strategy to reduce carbon emissions and encourage the adoption of cleaner vehicles. These changes aim to balance the need for environmental sustainability with the economic realities faced by drivers. Here are the key updates:

Fuel Duty Adjustments:

The government has announced a freeze on fuel duty for petrol and diesel vehicles, maintaining the current rate of 52.95p per litre. While this may seem like good news for traditional vehicle owners, it comes amid rising fuel prices driven by global market fluctuations.Vehicle Excise Duty (VED) Changes:

VED, commonly known as road tax, is set to increase for both petrol and diesel vehicles. The hike is part of the government’s efforts to discourage the use of high-emission vehicles and incentivize the switch to cleaner alternatives.EV Incentives and Taxation:

Electric vehicles, which have enjoyed significant tax benefits in recent years, will now face new charges. Starting in 2025, EV owners will be required to pay VED, ending their exemption from road tax. Additionally, the Expensive Car Supplement threshold will be lowered, affecting luxury EVs with a list price above £40,000.

Impact on Petrol and Diesel Vehicle Owners

For drivers of petrol and diesel vehicles, the HMRC update presents a mixed bag of outcomes:

Fuel Duty Freeze:

The decision to freeze fuel duty provides some relief to drivers grappling with soaring fuel prices. However, this relief may be short-lived, as global oil market trends and geopolitical factors could continue to push prices higher.Increased VED Rates:

The rise in road tax for petrol and diesel vehicles will add to the overall cost of ownership. This move is designed to nudge consumers toward greener alternatives, but it could also place a heavier financial burden on those who rely on traditional vehicles for their daily needs.Long-Term Viability:

With the UK government planning to ban the sale of new petrol and diesel cars by 2030, the long-term viability of these vehicles is increasingly uncertain. Owners may face higher costs and lower resale values as the market shifts toward electric mobility.

Impact on Electric Vehicle Owners

Electric vehicle owners, who have enjoyed tax benefits and lower running costs, will also feel the impact of the HMRC update:

Introduction of VED for EVs:

Starting in 2025, EV owners will no longer be exempt from road tax. While this change aligns with the principle of fairness (as EVs become more common), it could dampen the financial appeal of electric vehicles for some buyers.

Expensive Car Supplement:

Luxury EVs priced above £40,000 will be subject to the Expensive Car Supplement, adding an extra £355 per year to their VED bill. This could affect the affordability of high-end electric models, such as those from Tesla, Audi, and Jaguar.Charging Infrastructure Costs:

While not directly related to the HMRC update, the cost of charging EVs is also rising. Public charging stations, in particular, have seen significant price hikes, making it more expensive for EV owners to recharge on the go.

Opinion: Are These Changes Fair?

The HMRC update has sparked debate about the fairness and effectiveness of these tax changes. On one hand, the government’s efforts to promote cleaner vehicles and reduce emissions are commendable. On the other hand, the new charges on EVs could discourage potential buyers at a time when the UK needs to accelerate its transition to electric mobility.

For petrol and diesel vehicle owners, the increased costs may feel like a penalty, especially for those who cannot afford to switch to an EV. Meanwhile, EV owners, who have already made a significant investment in cleaner technology, may feel unfairly targeted by the new taxes.

Ultimately, the success of these measures will depend on how well the government balances environmental goals with the economic realities faced by consumers.

What Does This Mean for the Future of Driving in the UK?

The HMRC update is a clear signal that the UK is committed to its net-zero emissions target. However, the transition to a greener future will not be without challenges. Here’s what we can expect in the coming years:

Accelerated Shift to EVs:

Despite the new taxes, the long-term trend toward electric vehicles is unlikely to change. Advances in battery technology, expanding charging infrastructure, and falling EV prices will continue to drive adoption.Rise of Hybrid Vehicles:

For drivers who are not ready to go fully electric, hybrid vehicles could offer a middle ground. These vehicles combine the benefits of petrol or diesel engines with electric motors, providing a more sustainable option without the range anxiety associated with EVs.Increased Focus on Affordability:

As the cost of owning and operating vehicles rises, automakers and policymakers will need to focus on making cleaner vehicles more affordable. This could include subsidies, grants, and incentives to offset the impact of higher taxes.

Conclusion

The HMRC update marks a significant moment in the UK’s journey toward a greener automotive future. While the changes bring new challenges for both petrol/diesel and electric vehicle owners, they also reflect the government’s commitment to reducing emissions and promoting sustainable transportation.

For consumers, the key takeaway is to stay informed and plan ahead. Whether you’re considering switching to an EV or sticking with a traditional vehicle, understanding the financial implications of these tax changes will help you make the best decision for your needs and budget.