Transporting a car across the border between Northern Ireland (NI) and the Republic of Ireland (ROI) requires navigating a maze of tax and registration rules, complicated by Brexit and the Windsor Framework. The Vehicle Registration Tax (VRT) in the ROI and Northern Ireland’s Driver & Vehicle Agency (DVA) registration process are central to this journey. This in-depth guide provides a step-by-step roadmap for importing a car from NI to ROI and vice versa, enriched with detailed calculations, real-world examples, and practical tips to ensure compliance and minimize costs.

Understanding Vehicle Registration Tax (VRT)

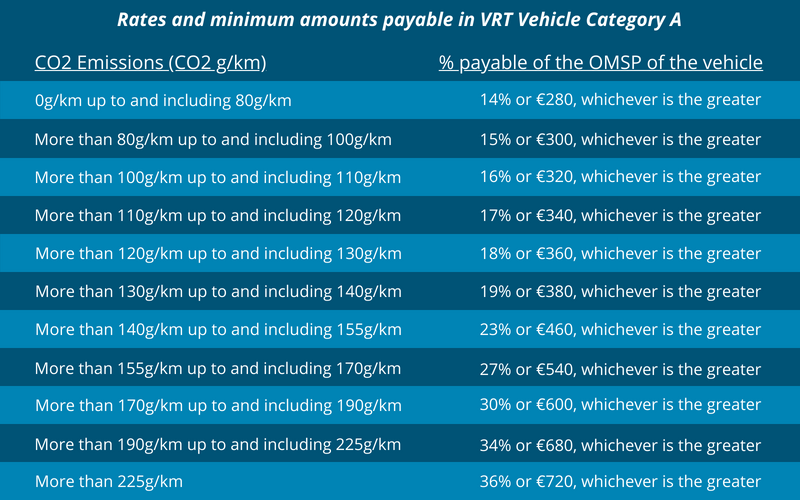

In the Republic of Ireland, Vehicle Registration Tax (VRT) is a mandatory tax applied when a vehicle is registered for the first time, whether new or imported from NI. It’s calculated based on the vehicle’s Open Market Selling Price (OMSP), CO2 emissions (using the WLTP standard since 2021), and a Nitrogen Oxide (NOx) levy for certain vehicles. The tax incentivizes low-emission vehicles and is managed by the Revenue Commissioners.

Northern Ireland, part of the UK, does not impose VRT. Instead, vehicles are registered with the DVA and subject to annual Vehicle Excise Duty (VED), based on CO2 emissions or engine size. The Windsor Framework aligns NI with EU trade rules, affecting customs and VAT for cross-border movements.

Importing a Car from Northern Ireland to the Republic of Ireland

Bringing a car from NI to the ROI typically requires paying VRT and registering with the National Car Testing Service (NCTS), unless exemptions apply. Below is a detailed breakdown with examples and calculations.

1. Registration Requirements in the ROI

Timeline: Book an NCTS appointment within 7 days of the vehicle entering the ROI and complete registration, including VRT payment, within 30 days. Non-compliance risks fines or vehicle seizure.

Inspection: The NCTS inspects the vehicle to verify details (e.g., CO2 emissions, odometer, make/model) for VRT calculation.

Required Documents:

V5C Registration Certificate (proving NI registration/ownership).

Proof of Identity (passport, driver’s license).

Proof of Address (utility bill, bank statement).

Personal Public Service (PPS) Number (Social Services Card, P60).

Vehicle Purchase Details Form (VRTVPD2) for private vehicles.

Certificate of Conformity (CoC) or emissions test results.

Vehicle history records (e.g., MOT, customs declarations).

Customs and VAT: Per the Windsor Framework, vehicles used privately in NI for a “reasonable period” (evidenced by V5C or MOT history) are exempt from customs duties. Vehicles imported to NI from Great Britain (GB) post-31 December 2020 may require a customs declaration. Without it, customs duties (10%) and VAT (23%) may apply for “new” vehicles (under 6,000 km or registered less than 6 months).

2. Calculating VRT with Examples

VRT is based on:

Open Market Selling Price (OMSP): Revenue’s estimated value in Ireland, not the NI purchase price.

CO2 Emissions: Rates range from 7% to 41% of OMSP, based on WLTP CO2 bands.

NOx Levy: Applied to diesels, ranging from €5–€200+ based on NOx emissions (g/km).

VRT Rate Table (2025, Simplified):

CO2 Band (g/km) | VRT Rate (% of OMSP) |

|---|---|

0 (EVs) | 7% |

81–100 | 10.5% |

141–155 | 17.5% |

171–190 | 23% |

226+ | 41% |

Example 1: Petrol Hatchback (2023 Volkswagen Golf)

Details: Used, 10,000 km, 150 g/km CO2 (Band 12), petrol, purchased in NI for £22,000.

OMSP: €30,000 (Revenue’s estimate).

VRT Rate: 17.5% (Band 12).

VRT Calculation: €30,000 × 17.5% = €5,250.

NOx Levy: €0 (petrol, negligible NOx).

Total VRT: €5,250.

Customs/VAT: Exempt (used vehicle, NI-registered for over 6 months).

Example 2: Diesel SUV (2022 Audi Q5)

Details: Used, 15,000 km, 180 g/km CO2 (Band 14), diesel, purchased in NI for £30,000.

OMSP: €42,000.

VRT Rate: 23% (Band 14).

VRT Calculation: €42,000 × 23% = €9,660.

NOx Levy: 30 g/km NOx × €10/g = €300.

Total VRT: €9,960.

Customs/VAT: Exempt (used, NI V5C provided).

Example 3: Electric Vehicle (2023 Tesla Model 3)

Details: Used, 8,000 km, 0 g/km CO2, purchased in NI for £35,000.

OMSP: €40,000.

VRT Rate: 7% (Band 1).

VRT Calculation: €40,000 × 7% = €2,800.

NOx Levy: €0.

Total VRT: €2,800.

Customs/VAT: Exempt (used, NI-registered).

Use calculators on www.vrt.ie or www.carzone.ie for estimates.

3. Exemptions and Reliefs

Transfer of Residence Relief:

Eligibility: Owned vehicle for 6 months, resided in NI 185 days/year, imported within 12 months of moving, kept for 12 months post-registration.

Example: Sarah moves from Belfast to Dublin, bringing her 2022 Ford Fiesta (owned for 2 years). She applies for relief with V5C and proof of NI residence, avoiding €4,000 VRT.

Process: Submit VRT Transfer of Residence Form within 7 days, receive exemption letter for NCTS.

Temporary Exemption: NI residents visiting ROI for under 6 months avoid VRT if the vehicle is NI-taxed/insured.

Company Cars: ROI residents using NI-registered company cars for work may get temporary relief (Revenue approval required).

EVs: Lowest VRT rate (7%), no NOx levy.

4. Additional Costs

Motor Tax (annual, ROI):

Petrol Hatchback (150 g/km): €390/year.

Diesel SUV (180 g/km): €570/year.

EV (0 g/km): €120/year.

NCT Inspection: €55 for vehicles over 4 years (unless EU Roadworthiness Certificate is valid).

Number Plates: €30–€50.

Insurance: €500–€1,500/year (varies by driver/vehicle).

5. Step-by-Step Process

Purchase Vehicle: Secure V5C, MOT history, and customs documents.

Check Customs: Verify NI use to avoid duties/VAT (especially for GB-sourced vehicles).

Book NCTS: Schedule within 7 days (www.ncts.ie, 01-4135975).

Prepare Documents: Identity, address, PPS, VRTVPD2, CoC, history records.

NCTS Inspection: Pay VRT, receive Irish registration.

Finalize: Buy plates, pay motor tax, arrange insurance.

Importing a Car from the Republic of Ireland to Northern Ireland

Importing from ROI to NI is simpler, with no VRT, but requires DVA registration and UK compliance.

1. Registration Requirements in NI

Timeline: Register promptly for legal use, no strict deadline.

Export Notification: Complete the Permanent Export section of the Irish Vehicle Registration Certificate (VRC) and submit to DVA.

Documents:

Irish VRC.

Proof of identity (passport, driver’s license).

Proof of address (utility bill).

NI insurance proof.

MOT certificate (vehicles over 3 years).

Customs/VAT: No customs duties for ROI-used vehicles (Windsor Framework). VAT applies only to “new” vehicles.

2. Vehicle Tax (VED) with Examples

Calculation:

Post-1 March 2001: Based on CO2 emissions.

Pre-2001: Based on engine size (>1,549 cc: £345/year; ≤1,549 cc: £210/year).

Example 1: Petrol Hatchback (150 g/km): £190/year.

Example 2: Diesel SUV (180 g/km): £345/year.

Example 3: EV (0 g/km): £0/year.

Pay online (www.gov.uk/vehicle-tax) or at a Post Office.

3. MOT Testing

Vehicles over 3 years (4 for goods vehicles) need an MOT (€30–€40) unless a valid ROI NCT is recognized temporarily.

4. Exemptions

Temporary Use: ROI residents using cars in NI for short periods (e.g., commuting) may retain ROI registration if taxed/insured.

Permanent Residents: Must register with DVA.

5. Step-by-Step Process

Notify Export: Complete VRC export section, send to DVA.

Secure Insurance: Arrange NI-compliant coverage.

Book MOT: If over 3 years and no valid NCT.

Register with DVA: Submit VRC, identity, address, insurance. Receive V5C with NI number.

Pay VED: Online or Post Office.

Get Plates: Purchase UK-style NI plates (€20–€40).

Brexit and Cross-Border Dynamics

NI to ROI: NI-used vehicles avoid customs duties, but VRT applies. GB-sourced vehicles need customs proof.

ROI to NI: No VRT, no customs duties (EU alignment). Only VED and registration apply.

Post-Brexit Impact: GB-to-NI imports may trigger customs checks, affecting ROI imports if undocumented.

Practical Tips for Success

Vehicle History: Check via www.carzone.ie or www.cartell.ie to confirm NI/GB status.

Cost Estimators: Use www.vrt.ie or www.carzone.ie for VRT/VED.

Professional Assistance: Engage dealers like Charles Hurst or VRT Ireland for paperwork.

Budgeting:

ROI: VRT (€2,800–€10,000+), motor tax (€120–€2,350), NCT (€55), plates (€50).

NI: VED (€0–€600), MOT (€40), plates (€40).

Exemptions: Apply early for residence relief to save thousands.

Conclusion

Moving a car between NI and ROI demands careful planning. In the ROI, VRT (7–41% of OMSP) is a major cost, offset by exemptions for EVs or relocating residents. In NI, DVA registration and VED are simpler, with no VRT. By understanding calculations, preparing documents, and leveraging exemptions, you can navigate the process efficiently.

Resources:

ROI: www.revenue.ie (VRT/customs), www.ncts.ie (appointments).

NI: www.nidirect.gov.uk (DVA/tax).

Calculators: www.vrt.ie, www.carzone.ie.

This blueprint equips you to tackle cross-border car imports with confidence.