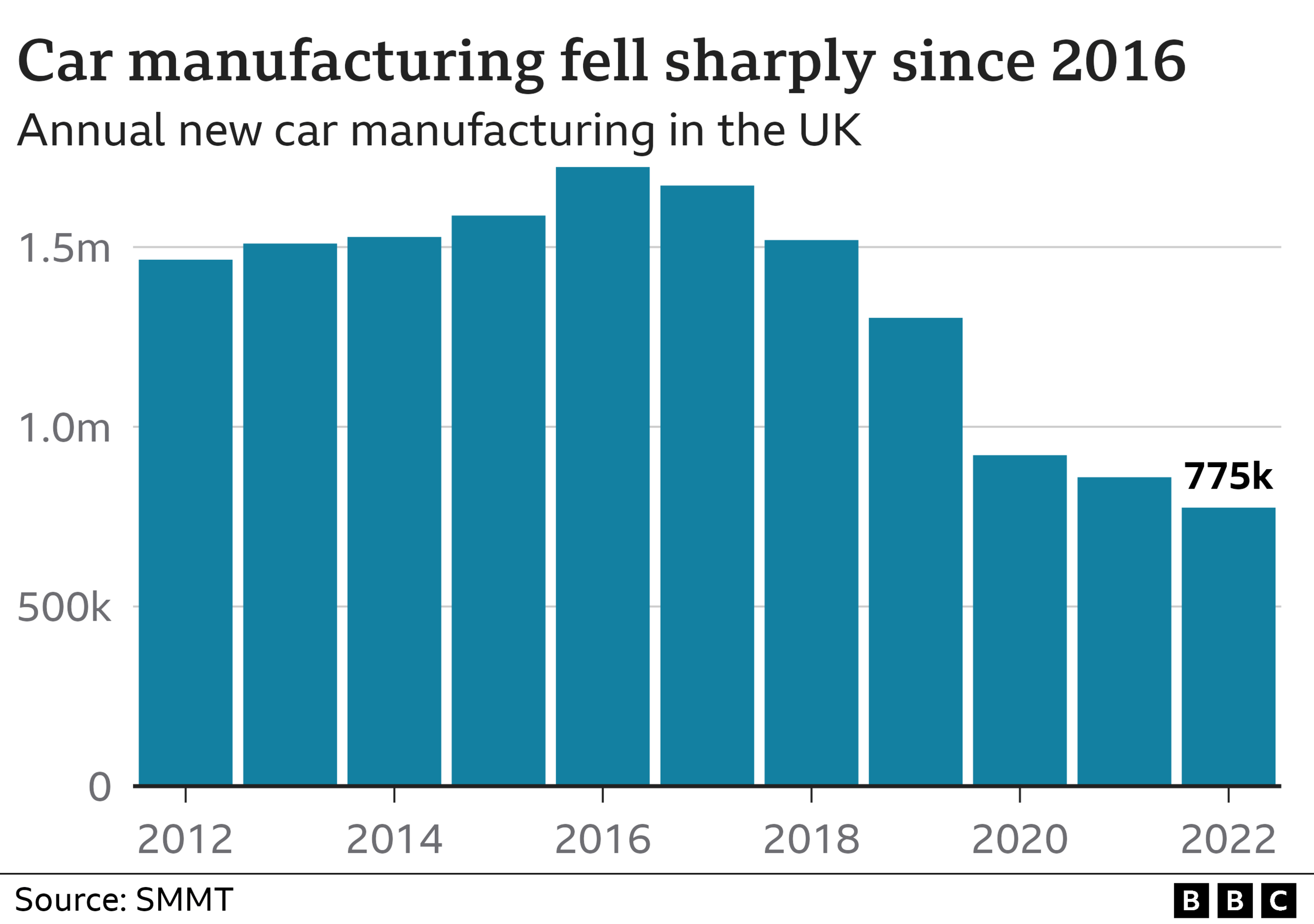

The UK’s car manufacturing industry has taken another massive hit, with production figures for 2024 sinking to their lowest levels since 1954. According to data from the Society of Motor Manufacturers and Traders (SMMT), just 780,000 vehicles were produced in the UK last year, marking a significant decline from the industry’s peak of 1.7 million in 2016.

This drop—excluding the extraordinary disruptions caused by the COVID-19 pandemic—raises serious concerns about the future of British car manufacturing. Global supply chain issues, Brexit complications, and the urgent push towards electric vehicles (EVs) have all played a part. But just how bad is the situation, and can the UK car industry recover?

UK Car Manufacturing: A Declining Industry?

The UK was once a world leader in car production, home to household names like Jaguar, Mini, Land Rover, and Vauxhall. In the 1970s, British factories were producing well over 1.5 million cars per year, supplying both the domestic market and exporting vehicles globally. However, over the past few decades, multiple factors have chipped away at the industry’s strength, leading to job losses, factory closures, and declining global competitiveness.

Production Figures Over the Years

| Year | Total UK Car Production |

|---|---|

| 1972 | 1.92 million |

| 2000 | 1.63 million |

| 2016 | 1.72 million |

| 2022 | 775,014 |

| 2024 | 780,000 |

The 2024 figure—while slightly improved from 2022—demonstrates that the industry is still struggling. But why has the UK’s car output collapsed so dramatically?

The Key Reasons for the Decline

1. Brexit’s Lasting Impact on the UK Car Industry

Since the UK officially left the European Union in 2020, British car manufacturers have faced increased costs, trade barriers, and regulatory hurdles. The UK’s departure from the EU’s single market has particularly affected the just-in-time supply chain model—a method relied on by car manufacturers to keep production efficient.

- Extra tariffs and paperwork have made it more expensive to import components and export finished vehicles to the EU.

- Border delays have disrupted the supply of crucial parts, slowing down production lines.

- EU-based manufacturers are prioritizing investments in their home countries rather than in UK plants, leading to reduced production capacity.

2. Semiconductor Shortages & Supply Chain Disruptions

The automotive industry has been hit hard by a global shortage of semiconductors (microchips essential for modern cars). This issue, which began during the COVID-19 pandemic, has persisted due to ongoing geopolitical tensions and high demand from other industries like consumer electronics.

- Modern vehicles rely on over 1,000 semiconductor chips for everything from infotainment systems to safety features.

- With limited supply, manufacturers have been forced to prioritize high-margin models like luxury SUVs over smaller, mass-market cars, leading to lower production figures overall.

- Some factories have had to temporarily shut down due to lack of critical components, further reducing output.

3. The Struggle to Transition to Electric Vehicles (EVs)

The push towards EVs is essential for meeting the UK government’s 2035 ban on new petrol and diesel cars, but the transition has created major challenges for manufacturers:

- Lack of UK-based battery production: While countries like Germany and China have invested heavily in "gigafactories" to produce EV batteries, the UK is still lagging behind. Without domestic battery production, UK-built EVs rely on expensive imports.

- Slow EV adoption rates: Many consumers are still hesitant to switch to electric, citing concerns over price, charging infrastructure, and range anxiety. This has led to uncertainty in production planning.

- Existing petrol/diesel-focused factories need retooling: Converting traditional production lines to EV-friendly plants requires billions in investment. Some companies, like Honda, have opted to shut down UK operations rather than retrofit their factories.

4. The Declining Appeal of UK Manufacturing

Big car brands are increasingly choosing to invest elsewhere rather than expand or maintain UK production. Why?

- Cheaper labor costs in Eastern Europe and Asia make those locations more attractive for new plants.

- Brexit-related uncertainty has deterred major investments.

- Government incentives in other countries (like the US Inflation Reduction Act) have made places like the US, China, and Germany more appealing for car manufacturers.

Major blows to UK car production in recent years include:

🚗 Honda closing its Swindon plant in 2021, leading to 3,500 job losses.

🚗 Ford shifting engine production from Wales to Mexico, impacting 1,700 workers.

🚗 BMW moving electric Mini production to China, reducing UK factory output.

These moves signal a worrying trend for the future of UK car manufacturing.

Industry Reactions & Government Response

The steep decline in production has led to increasing pressure on the UK government to intervene and support the struggling industry. Industry leaders have called for urgent action to prevent further decline.

What the Experts Say

🚘 Mike Hawes, CEO of SMMT:

"The UK must take immediate steps to make itself more competitive. We need investment in battery production, better trade deals, and incentives for manufacturers to keep operations here."

🚘 Richard Peberdy, UK Head of Automotive at KPMG:

"Without a strong battery supply chain, the UK risks being left behind in the EV race. Major investment is needed now, or production will continue shifting overseas."

Government’s Plans

In response, the UK government has announced several measures aimed at reviving car manufacturing:

✅ Investment in Gigafactories: £3.8 billion has been committed to developing battery plants, including Britishvolt’s planned facility in Northumberland.

✅ EV Infrastructure Expansion: Grants for more charging stations to accelerate consumer adoption of electric vehicles.

✅ Trade Agreements: Ongoing negotiations to ease post-Brexit trade barriers with the EU and beyond.

But will these measures be enough?

Can UK Car Manufacturing Recover?

Despite the bleak outlook, there are still opportunities for a revival of UK car production—if the right actions are taken. Key areas of focus should include:

🔹 Attracting foreign investment to encourage global manufacturers to build cars in the UK.

🔹 Boosting battery production to support the transition to EVs and reduce reliance on imports.

🔹 Enhancing trade deals to ensure UK-built cars remain competitive in the European market.

🔹 Improving workforce skills by training workers in EV and battery technology.

Some companies are still betting on the UK, with Nissan recently announcing plans to expand EV production at its Sunderland plant. However, much more investment is needed to truly turn things around.

Conclusion

The UK’s car manufacturing industry is facing its biggest crisis in decades. With production hitting a 70-year low, Brexit challenges, supply chain issues, and the EV transition are all playing a role in the downturn.

While government initiatives and private investments could provide a lifeline, urgent action is needed to prevent further factory closures and job losses. Without a solid plan to support domestic production, the UK risks losing its automotive industry altogether.

Will the UK car industry recover, or is this the beginning of the end for mass vehicle production in Britain? Only time will tell.